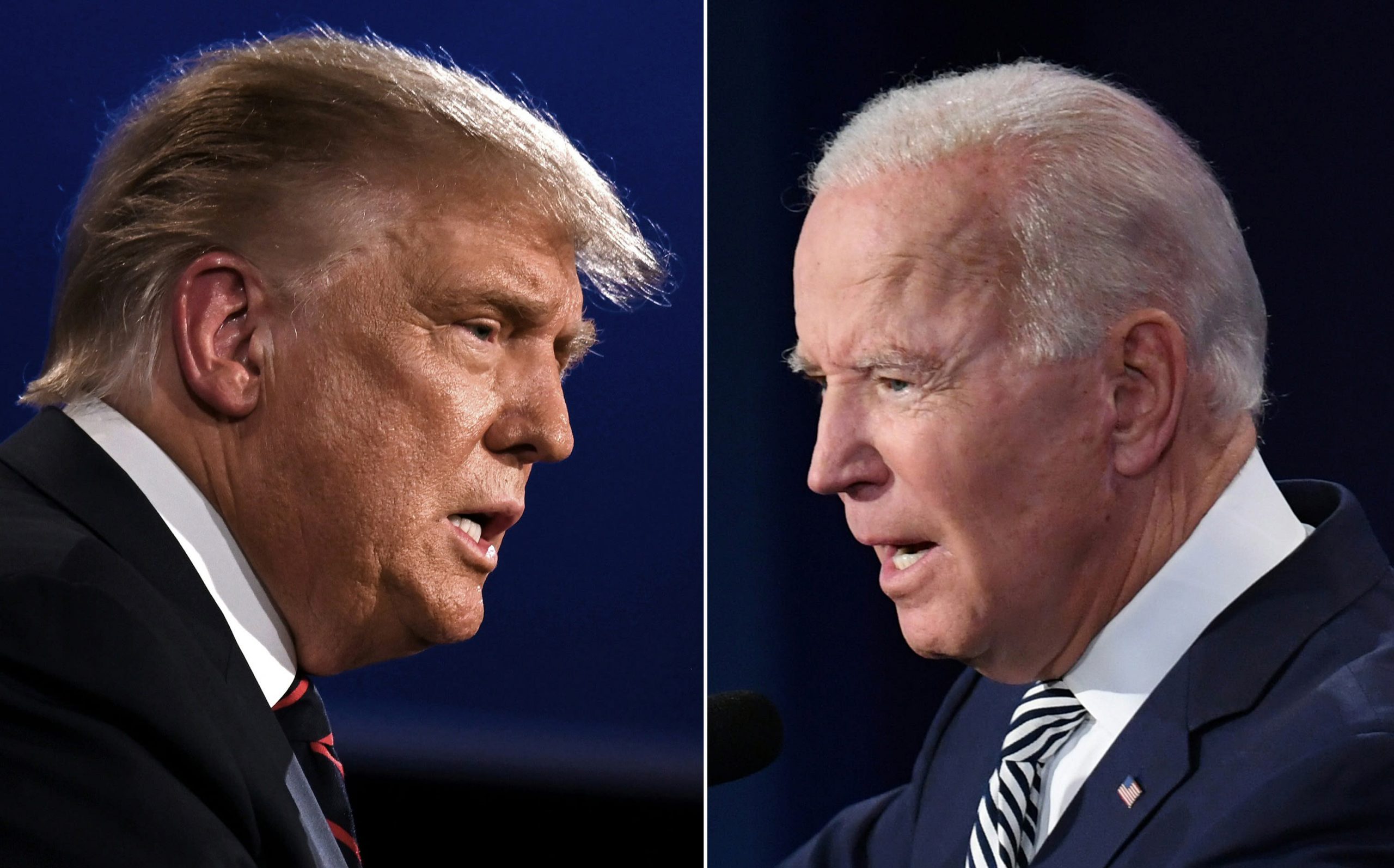

US President Donald Trump (L) and Democratic Presidential candidate former Vice President Joe Biden pictured throughout the first presidential deba

US President Donald Trump (L) and Democratic Presidential candidate former Vice President Joe Biden pictured throughout the first presidential debate on the Case Western Reserve College and Cleveland Clinic in Cleveland, Ohio on September 29, 2020. For small enterprise homeowners throughout the nation, casting a poll within the 2020 election presents a tough sequence of financial, private and political selections.

Getty Photos

For enterprise tax knowledgeable Tony Nitti, the importance of this 12 months’s presidential election for Predominant Road entrepreneurs cannot be understated.

“With zero hesitation, I can say that is the toughest voting determination small enterprise homeowners have ever confronted,” mentioned the companion centered on federal tax on the accounting agency RubinBrown.

A coronavirus pandemic that has rocked many small companies and precipitated a beforehand buzzing economic system to fall into recession, civil unrest that led to downtown closures throughout the U.S., a cultural divide that’s greater than ever earlier than — and that is earlier than taking into consideration the variations between President Trump and Joe Biden on the core enterprise, tax and commerce points that traditionally have guided many enterprise proprietor voting choices.

“I do assume there are extra variables this election than in latest elections,” mentioned Kevin Kuhlman, vp of federal authorities relations on the Nationwide Federation of Impartial Companies. “The coverage variations are stark, and now we have the pandemic creating uncertainty and want for added monetary help. There are various short-term and long-term points that might consider, and would decide tough.”

Entrepreneurs do vote in giant numbers — 95% of small-business homeowners vote often in nationwide contests, in line with the Nationwide Small Enterprise Affiliation — and the demographic does skew conservative. Forty % of small-business homeowners determine as Republican, versus 29% figuring out as Democrats, and one other 25% who say they’re impartial. An growing portion of enterprise homeowners point out that they’re voting on a extra polarized foundation. Straight get together ticket votes have elevated from 18% in 2014 to 27% immediately, in line with a forthcoming survey from the commerce group. In 2016, 40% mentioned that neither get together greatest represents their small enterprise, however immediately, that quantity is all the way down to 26%.

“An increasing number of are choosing sides,” mentioned Molly Day, NSBA spokeswoman.

Listed here are just a few of the largest enterprise and financial points that homeowners are weighing as they forged votes in 2020.

Company tax

We all know extra about Biden’s tax platform than Trump’s for a second time period, however that’s as a result of the Trump administration handed the largest tax cuts in a long time, so specifics about its future tax strikes are much less in focus, mentioned Nitti. For Trump, making the tax cuts handed in 2017 everlasting in a second time period is probably going essentially the most vital challenge for enterprise homeowners, as some key provisions will expire in 2025 primarily based on present regulation.

That features the 199A deduction which has allowed taxpayers with earnings from pass-through companies, comparable to sole proprietorships, firms, and partnerships, to deduct as much as 20% of their certified enterprise earnings from their particular person taxes.

The 2017 tax regulation adjustments additionally lowered the company charge to 21% for C firms and that led extra companies to restructure as C firms to take benefit. Biden is campaigning on a rise to a 28% charge — which might nonetheless be decrease than the company tax charge was in 2016 — however would change the maths for companies that just lately reclassified. And if the Democrats take the Senate along with presidency, tax adjustments might occur rapidly. “Numerous companies that welcomed the C corp should give it a re-evaluation. For the final 31 years it was the entity of final alternative,” Nitti mentioned.

NFIB’s Kuhlman mentioned as a result of nearly all of small companies are “go by means of” entities when sole proprietors are included.

“For individuals who are centered on tax points and are pleased with the present tax scenario and the present charges and thresholds, they might probably help Trump’s tax and financial imaginative and prescient,” Kuhlman mentioned, including that it’s made much more probably by the truth that the tax adjustments might expire in 2025 and Trump plans to make them everlasting, if reelected.

Revenue, capital positive aspects taxes, and $400,000

Trump additionally has talked about decreasing the highest capital positive aspects tax charge to 15%, which for enterprise homeowners trying to exit within the subsequent few years, might be vital, in line with Nitti.

The president additionally has talked about eliminating payroll taxes, although there was little help for the idea, even amongst his personal get together. However Nitti mentioned that as a small enterprise proprietor, there’s a decrease present tax burden due to the 199A deduction, and it might be diminished much more with a low capital positive aspects tax and low payroll taxes. Whereas perhaps not going, the tax companion mentioned that, generally, Trump’s strategy to taxes can lead to a clear-cut vote for enterprise homeowners who see taxes as an enormous challenge.

“The whole lot we’re listening to from Trump is a standard theme of lowering the tax burden. The GOP will not run on a platform of elevating taxes for anybody, not to mention small enterprise,” Nitti mentioned.

That’s the reason in the case of taxes, his purchasers are paying essentially the most consideration to what occurs if Biden wins. “His platform makes no bones about growing taxes,” the tax companion mentioned.

The Biden tax platform does point out that incomes below $400,000 a 12 months is not going to expertise any tax will increase, together with provisions like 199A deductions.

“Most are making lower than $400,000 a 12 months and mustn’t have a tax enhance coming,” Nitti mentioned, however he added that there are clearly small companies and homeowners that make over that degree and they’re going to expertise a tax enhance below a Biden presidency. Extra earnings and capital positive aspects taxes, and payroll and Social Safety taxes on taxpayers over $400,000, are a difficulty for entrepreneurs to think about.

Biden has promised that for taxpayers on the increased ranges of earnings above $400,000, the highest particular person tax will revert to 39.6%, up from 37% at present. Lengthy-term capital positive aspects may even be taxes at 39.6% on earnings above $1 million.

That may be vital for small enterprise homeowners holding helpful property that they could be doubtlessly promoting sooner or later and Nitti mentioned it’s a dialog he’s having with purchasers on a regular basis, with many entrepreneurs fearful about how briskly that tax change might turn out to be regulation and whether or not they need to be promoting their enterprise sooner moderately than later.

“They’re undoubtedly taking this critically proper now,” he mentioned. A enterprise could have by no means had a really vital windfall in any given 12 months, however “promoting a life’s work” is a seminal second, he mentioned, and when an proprietor does exit the enterprise they don’t need to pay a a lot increased tax charge on the sale and any actual property that might be included as a part of it as effectively.

Property tax

As older homeowners plan their exit methods, they do need to know that they’ve the choice to go on the wealth they’ve created to heirs on favorable tax phrases within the occasion of dying. Biden is planning to make adjustments to property taxes which is able to have an effect on the wealthiest Individuals, and a few small enterprise homeowners amongst them.

Among the many most vital is Biden’s deliberate elimination of the step-up foundation for passing on property to heirs, one thing to which small enterprise homeowners pay shut consideration.

Nitti mentioned there will likely be methods for enterprise homeowners to regulate their estates and restrict the potential hit, however it does imply they should sit down with property planning specialists and put in place a brand new plan to guard their property. Doing nothing might finally imply taking a a lot greater property tax hit.

NFIB’s Kuhlman mentioned the person tax charges and pass-through charges are the best precedence, adopted by the company charge, after which property taxes. The share of small companies that have to do planning round property taxes is critical, Kuhlman mentioned, and whereas there are alternatives to reduce tax penalties, it takes time and assets.

Covid-19

Small enterprise tax specialists mentioned that on this election, even with all the potential tax implications, it may be laborious for entrepreneurs to deal with the longer-term view when they’re fearful about making it to subsequent 12 months.

Kuhlman mentioned latest surveys carried out by the NFIB do exhibiting enhancing confidence amongst enterprise homeowners, however extra stimulus is required for small companies and with out one other spherical of economic help from the federal authorities many companies is not going to be round sooner or later to fret about their tax charges.

That isn’t a difficulty which Predominant Road blames on anyone determine. “Enterprise homeowners are offended at everybody,” Kuhlman mentioned. “I feel the dialogue of tax coverage and labor coverage and even health-care are again of thoughts, and entrance of thoughts, high of thoughts is the very acute and pressing risk,” he mentioned.

Based on the NFIB, about half of enterprise homeowners anticipate needing further monetary assist in the following 12 months. What’s extra irritating for Predominant Road is that “it is by no means been the small enterprise components holding again a deal,” he mentioned. “We’re recovering from close to document lows in small enterprise confidence over the summer season and that is good, however the uncertainty components of that additionally proceed to be excessive.”

“They blame everybody,” mentioned Nitti. “”However Trump is the person in cost and the buck stops there, and we must always not nonetheless be on this scenario. The argument may be made that the economic system can by no means get well till the pandemic is below management.”

Tax coverage is all the time vital to small enterprise and that can test the field for Trump. … However now we have this bizarre dichotomy. They belief a Trump presidency will enable them to open the doorways, however do not feel assured a Trump presidency will maintain the pandemic in a method that retains family and friends and prospects protected.

Tony Nitti

federal tax companion at RubinBrown

The pandemic leaves small enterprise homeowners with what can appear to be some almost-impossible selections. A vote for Trump might imply a vote for extra liberal reopening insurance policies and extra enterprise safety from legal responsibility associated to Covid instances amongst staff and prospects.

However Nitti mentioned for some enterprise homeowners who voted for Trump in 2016 largely primarily based on hopes for a tax minimize, the final 4 years culminating in Covid-19 have led them to conclude that it wasn’t value it. “They may go in a special path, and the pandemic modified that,” he mentioned.

“Tax coverage is all the time vital to small enterprise and that can test the field for Trump. … However now we have this bizarre dichotomy. They belief a Trump presidency will enable them to open the doorways, however do not feel assured a Trump presidency will maintain the pandemic in a method that retains family and friends and prospects protected.”

“The pandemic isn’t partisan. Simply because Trump will get reelected does not imply companies can reopen, or Biden that the pandemic goes away,” he added.

NFIB has pushed again towards the kind of emergency requirements that Biden helps OSHA setting up, and of which labor unions have been robust proponents.

Kuhlman described the controversy over enterprise legal responsibility as one other instance of “stark” coverage variations and he famous that over half of its small enterprise survey viewers haved point out all through the pandemic that they’re very involved about lawsuits, an information level that has ranged from 55% to 70% in latest work, and but there appears to be an absence of center floor in D.C. It is a matter he famous that Home Speaker Nancy Pelosi has mentioned is a sticking level, and Senate Majority Chief Mitch McConnell has known as a “crimson line.”

Small enterprise homeowners in their very own phrases

Not all small enterprise homeowners are being pushed by core tax components or basic regulatory positions of the 2 main events. Some small enterprise homeowners are nonetheless extra impacted by Trump’s commerce battle with China than another issue, and entrepreneurs are people — some are swayed extra by private political philosophies and fears.

Adam Miller, 28-year-old proprietor of Revel Bikes, a high-end bike producer in Carbondale, Colorado, says the pandemic has led to a increase in his enterprise as extra Individuals flock to out of doors actions and away from abroad holidays, and stimulus in response to Covid triggered extra shopper spending. “I really feel like I could not be luckier. We are able to barely sustain with demand,” he mentioned.

However Miller — who as an out of doors fanatic has issues with Trump’s environmental document and as an proprietor just lately started providing medical health insurance to all of his 18 staff although it was pricey as a result of he believes well being care is a primary proper — is voting for Biden.

“I’m on the liberal facet of issues, which is hard while you personal a small enterprise. I’m fairly within the center in the case of taxes as a result of I can see the GOP facet of issues,’ Miller mentioned, explaining that increased taxes means much less cash for entrepreneurs to reinvest, and that may imply much less hiring.

However whether or not the tax charge is increased or decrease, he mentioned the uncertainties that include a Trump presidency weigh extra closely on his vote. Although it has moved some manufacturing to different components of Asia in recent times, Revel depends to a big diploma on manufacturing in China. Miller, who funded his enterprise “with my home and financial institution loans” mentioned the mixture of tariffs and the always altering administration place on commerce is a bigger concern than paying extra in taxes.

“Biden will make it so I pay 7% extra in taxes, but when I haven’t got unknown and radical adjustments making it laborious to do provide chain planning, I am assured I am going to make extra income,” Miller mentioned. “I spent the final 4 years of my life flying to China as soon as each few months. Any enterprise proprietor who manufactures abroad ought to steer far-off from a Trump presidency.”

The pandemic has added to his vote towards Trump primarily based on uncertainty. “If I have a look at the brief time period, we cannot have as many mandates below Trump as Biden for opening and shutting, however long-term, if this virus isn’t below management, we are going to maintain having the identical issues,” Miller mentioned. “If the pandemic isn’t below management, it would damage all of us long run.”

He see Biden as a vote for stability. “As a enterprise proprietor, if you’re placing out fires day-after-day, how will you run a enterprise below that regime?”

Different enterprise homeowners are viewing stability in phrases extra carefully aligned with particular person political preferences. Ben Thomas, proprietor of 5 Pound Attire in Springfield, Missouri, who identifies as impartial, voted for Trump within the final election and mentioned he’s leaning that method once more. He sees the pandemic as a worldwide downside over which it’s unfair guilty Trump.

I want Trump would act extra presidential typically, and I hear many individuals say they cannot take it and that is why they will not vote for him. In my circle, everybody simply talks about how they need there have been higher choices on the desk.

Ben Thomas

proprietor of the 5 Pound Attire retail store in Springfield, Missouri

He’s not pleased with Trump’s messaging on masks, however his retail store has held up effectively throughout the pandemic, and being shut down for roughly seven weeks compelled Thomas to launch a web based store and month-to-month subscription service — concepts he was serious about pre-Covid however didn’t enact till the pandemic triggered fast motion. Now gross sales are much like the extent from earlier than coronavirus.

Thomas isn’t motivated to vote for Trump primarily based on the pandemic, or taxes. “Taxes are a kind of issues essential to function in a rustic the place we pave roads, and everyone seems to be a part of the system … it does not play into how I view the election. I’d say I vote extra as a person,” he mentioned.

Finally, he’s being swayed by concern, however not the identical fears that Miller has of a Trump second time period and uncertainty weighing on enterprise choices. The truth is, for Thomas, even amid the pandemic, the present president is the higher guess for stability.

“I’m slightly bit fearful of what Biden would do … insurance policies just like the Inexperienced New Deal. … Change for the sake of change is not good,” Thomas mentioned. “I undoubtedly choose a candidate apart from Trump or Biden. I feel Biden is a comparatively reasonable Democrat however I do not know if he can combat off the far left progressives within the get together. … I want Trump would act extra presidential typically, and I hear many individuals say they cannot take it and that is why they will not vote for him. In my circle, everybody simply talks about how they need there have been higher choices on the desk. However elementary structural adjustments scare me extra, and are coming from the Democratic facet.”