Whenever you're simply beginning out, life insurance coverage will not be your first concern. Placing it off could value you.Analysis reveals that

Whenever you’re simply beginning out, life insurance coverage will not be your first concern. Placing it off could value you.

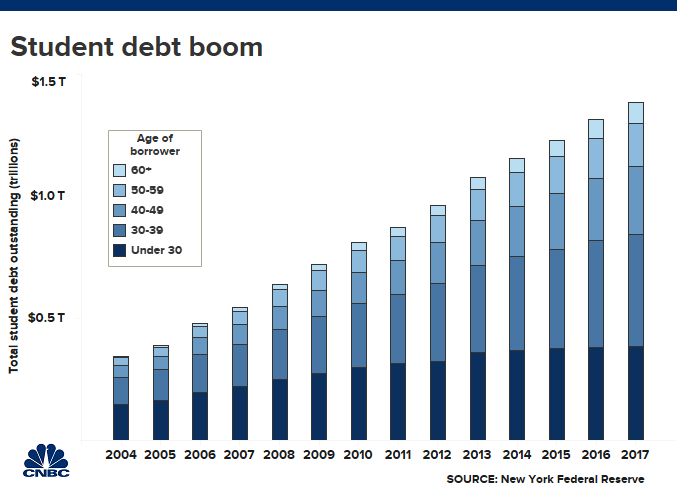

Analysis reveals that millennials, who’re saddled with hefty pupil mortgage payments, have struggled to set cash apart for different purchases — from life insurance coverage to buying a home.

On common, about 7 in 10 seniors graduate with debt, owing round $30,000 per borrower.

Nonetheless, life insurance coverage comes with a selected profit for pupil mortgage debtors: A coverage that covers the quantity owed to lenders can act as a approach of defending these loans from turning into a liked one’s burden.

Although excellent federal pupil loans are discharged if you die, that is not all the time the case with non-public loans. When a borrower with a non-public mortgage dies, the co-signer could also be on the hook for subsequent funds.

About half of personal pupil mortgage applications don’t supply death discharges, in keeping with SavingforCollege.com.

Extra from Make investments In You:

Not having a long-term care policy can crush your financial plan

When it pays to buy travel insurance

Don’t make this $42,000 mistake

Or, like with excellent pupil debt, when you took out a mortgage to start out a small enterprise, or any sort of unsecured mortgage, that mortgage stability would not die with you both. The lender can both dimension the collateral you used to safe the mortgage or eat up your entire belongings to repay the debt.

A life insurance coverage…